I generally don’t trust the “official” word on the economy. I believe that the best indicator of how the economy is going can be found in the small businesses on Main Street. And the word I am hearing from small business owners I work with is concerning. They are telling me that demand is starting to weaken. Even industries that typically see their strongest demand in the summer are seeing weak sales.

Also, when you dig into specific numbers about the economy, there are signs that affirm that the economy may be softening.

Possible Causes

There are several possible causes of a weakening economy.

There is evidence that consumers are backing off on most discretionary spending. A report from Deloitte released at the end of June 2024 states: “Discretionary spending intentions remain relatively weak as consumers continue to prioritize their savings.” A survey from McKinsey suggests possible causes for this slowdown in discretionary spending: “Economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market.” Both reports show some interesting exceptions to their findings. Younger consumers (Gen Z and younger Millennials) are still spending on dining out, travel, and apparel.

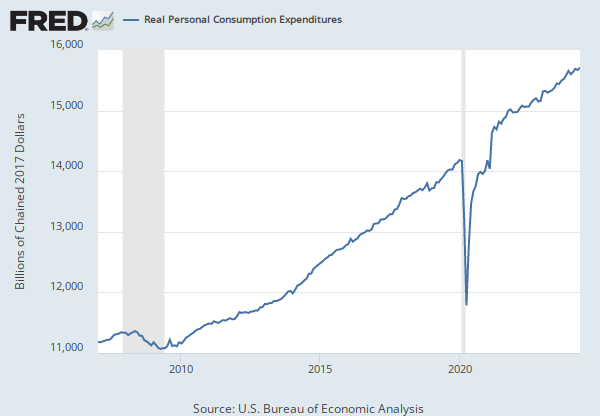

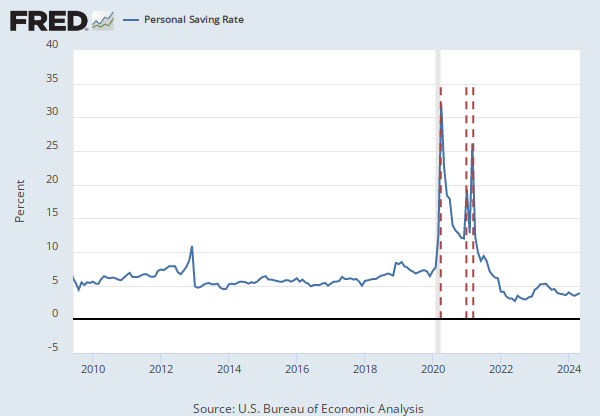

There also is evidence that we may be suffering from a COVID hangover. With the massive influx of cash from the federal government in 2020 and 2021, consumers behaved in ways not seen in recent memory. At first, with lots of new cash in their bank accounts, but while still being locked down, consumers drastically cut spending, increased their savings, and paid off debt.

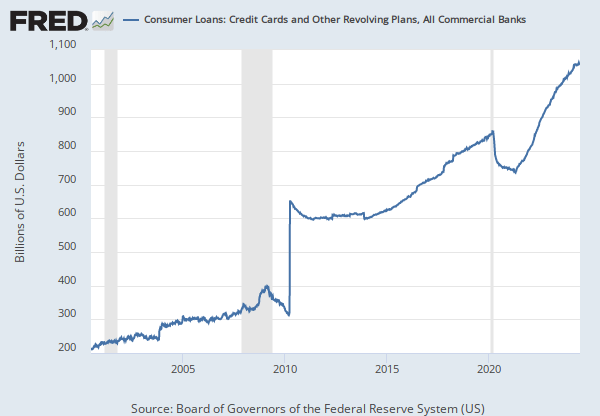

Then, by around 2022, consumers looked to credit cards after depleting their savings to support ongoing spending. Credit card debt soared to new heights.

What may be happening is more about returning to a new economic equilibrium now that consumers have spent all of their excess cash.

Finally, election year uncertainties are higher than ever, probably another source of consumer caution.

In truth, all of these factors are likely contributing to a softening of consumer spending.

So, what should a business owner do?

Tighten up Overhead

Watching your overhead is always a good idea, but it becomes crucial as revenues decline. Lowering overhead lowers a business’s breakeven point, which is the point at which you start losing money.

Pay Down Debt

Paying down debt will free up cash flow for when you may need it later if and when revenues decline. It also protects you if interest costs remain high.

Don’t Wait to React to Inflation

Inflation seems persistent right now. The best safeguard is to protect your profit margins. In addition to paying close attention to variable costs, try to stay ahead with pricing. Consumers are much more tolerant of frequent and smaller price increases than when you wait and try to do one big price increase to catch up with your increasing costs. Quarterly or even monthly small increases will be less noticeable to your customers.

Have a Plan

It is always good to have an “oh crap” plan in your back pocket. If you must make significant expense cuts to keep things afloat, have that plan ready. You may never need it, but having a cost-cutting plan in place is always a good idea.

And be ready to be decisive if you do have to act on your plan!