Clint Smith shares his experiences after the exit from his business. It is interesting the similarities and differences between retirement and an entrepreneur’s exit.

When Disruption Hits Retirement

Demystifying Retirement

Different Paths to Retirement

Conversation with Steve Harper at The Pond

Many years ago, I discovered The Ripple Effect by Steve Harper. As the book’s subtitle states, it was written to help you maximize the power of relationships in your life and business. Our students at Belmont University needed to learn from Steve’s Wisdom, so we started using it in one of our required courses for entrepreneurship majors.

Thankfully, I have stayed connected with Steve over the years. I recently joined his digital community called The Pond. I highly recommend this site for everyone! I am most active in a sub-community called Ripple Beyond for retired folks like me. I’ve already met some amazing people!

Steve and I got together to chat about my new book, Entrepreneurial Voices. You can listen in on our conversation here!

Serendipity: Luck and Business Success

In hindsight, most successful entrepreneurs look smart. A common view is that visionary entrepreneurs scan the world around them. Because they practice “entrepreneurial alertness,” they are able to identify opportunities in the market, which they seize and turn into successful businesses.

While this is sometimes true, success often comes from luck. One of my favorite books about the role of luck in entrepreneurial success is Heart, Smarts, Guts, and Luck by Tjan, Harrington, and Hsieth. They argue that although preparation, knowledge, and courage are all critical, we cannot overlook the role of luck in many of our business successes.

In two recent posts, I highlighted the role of serendipity in the success of Ryan Pruitt and his cafe business, Frothy Monkey, and Gordon Droitcour’s ventures in the music industry.

In this post, I will focus on four more examples of the role of serendipity in entrepreneurial success. My new book, Entrepreneurial Voices, contains all six of these stories.

Common Side Hustles

Holly Rachel and Lena Winfree met each other at church. They both were pursuing entrepreneurial side businesses. Holly was working on a blog for haircare, and Lena was formulating hair products. They decided to connect to see if they could develop a haircare business together. Holly’s day job was working in the forensic sciences lab Tennessee Bureau of Investigation. Lena helped create data interoperability between Nashville General Hospital and Meharry Medical College. Although it was their side businesses in haircare that brought them together, they soon realized that their day jobs were what created the best opportunity for them to form a business partnership consulting on technology and data issues in business.

Holly describes their realization this way:

We were thinking we were going to get some quick money and put it into our haircare business. It’s interesting how things kind of just start getting bigger and bigger. We realized a lot of people don’t know their data (Entrepreneurial Voices, p. 110).

A chance meeting in church and a shared interest in the haircare business led to the creation of a highly successful technology consulting firm!

COVID and Pickleball

Pickleball was a game for older folks when it first started gaining popularity. When I was still teaching college, I remember how students made fun of pickleball, comparing it to games like shuffleboard as something that their grandparents played. Pickleball then experienced a rather dramatic uptick in interest among younger players due to an unforeseen event: COVID. Young adults were no longer going into the office, meeting for beers after work, or going out to dinner with friends. They were stuck at home. Outdoor sports such as golf and tennis boomed during this time, allowing people to socialize within the governmental constraints imposed to combat COVID. And many of these young adults soon found that the game of their grandparents was a fun way to connect with friends during the lockdown.

Grace Moore, cofounder of Recess Pickleball, shared her experience when I interviewed her for my new book:

During COVID, people spent more time with family, and pickleball surfaced as a major trend. My husband and I loved the game. It allowed us to be outdoors, move our bodies, and be social and at a safe distance, which was crucial at that time. People all over the country got hooked and fell in love with pickleball (Entrepreneurial Voices, p. 113).

Grace and her partner Maggie Brown believed there was a need for pickleball equipment that fit the needs of this new demographic:

During COVID, we both played a lot of pickleball. We couldn’t find a single pickleball paddle that looked good. Everything was black and neon with dragons and volcanoes on it. We wanted to play with gear that matched our lifestyle and aesthetic (Entrepreneurial Voices, p. 113).

A global pandemic and drastic government policies led two friends to find a new passion and build a business based on that passion, which is still thriving today!

Chance Meeting Selling Shoes

A chance meeting in a shoe store led Skylar Faria into an industry he would never have dreamed of. Here’s how Skylar described it to me in our interview:

I’m working at Nordstrom. I was selling a pair of shoes, and a guy walked in with a 1980 College Baseball D-II World Series ring on. I was a part of the ’83 & ’85 world champion and runner up teams. He was older than I was. His name was Lance. I never knew him, but we kind of had that fraternal connection.

He said, “What are you doing here?”

And I said, “Well, hopefully, you’ll buy a pair of shoes.“ He was looking at a $240 pair of Allen Edmonds dress shoes. And I said, “What do you do?”

And he said, “I sell sandpaper. Skyler, there’s a position open in Southern California. You need to take it“ (Entrepreneurial Voices, p. 117).

This random encounter changed the trajectory of Skylar’s career. Eventually, Sylar had an opportunity drop into his lap to build his own company. A distressed family business was looking to sell. Skylar bought the business. His company, SurfPrep, is now an industry leader in innovation in sanding systems.

It all happened from a guy looking to buy a pair of shoes!

From Photography to Barbecue

Josh Gilreath had always known he wanted to be an entrepreneur. In high school, he started his first business in photography. He learned from his uncle, a well-known photographer in his hometown. Significant technological innovations in photography led to major disruptions, which left his business model behind. He then moved into construction, a business his parents had been in for many years. He had some success, but his heart was never really in the business.

Then, one weekend, Josh was at his parent’s house in Chattanooga. While at Walmart to pick up some chemicals for their pool, Josh eyed a smoker. He picked out an inexpensive one and made it an impulse purchase. He played around with it almost every weekend, developing his own rubs that he shared with friends and family.

When COVID hit, Josh found himself out of work and needing to make money. Josh described it this way:

We’ve got to kick this barbecue thing in the ass and figure out what the hell we’re going to do. It was a bonus having lost my job because the unemployment benefits helped bridge that gap for a couple of months and allowed me the freedom to figure out what we needed to do (Entrepreneurial Voices, p. 130)

Tennessee Rebel BBQ is another business serendipitously born out of the impact of COVID.

Serendipity

Although preparation and alertness are vital ingredients in entrepreneurial success, the role of luck should not be underestimated.

“There’ll always be serendipity involved in discovery.“ (Jeff Bezos)

Signs of Main Street Economy Softening

I generally don’t trust the “official” word on the economy. I believe that the best indicator of how the economy is going can be found in the small businesses on Main Street. And the word I am hearing from small business owners I work with is concerning. They are telling me that demand is starting to weaken. Even industries that typically see their strongest demand in the summer are seeing weak sales.

Also, when you dig into specific numbers about the economy, there are signs that affirm that the economy may be softening.

Possible Causes

There are several possible causes of a weakening economy.

There is evidence that consumers are backing off on most discretionary spending. A report from Deloitte released at the end of June 2024 states: “Discretionary spending intentions remain relatively weak as consumers continue to prioritize their savings.” A survey from McKinsey suggests possible causes for this slowdown in discretionary spending: “Economic pessimism grew slightly, fueled by concerns over inflation, the depletion of personal savings, and perceived weakness in the labor market.” Both reports show some interesting exceptions to their findings. Younger consumers (Gen Z and younger Millennials) are still spending on dining out, travel, and apparel.

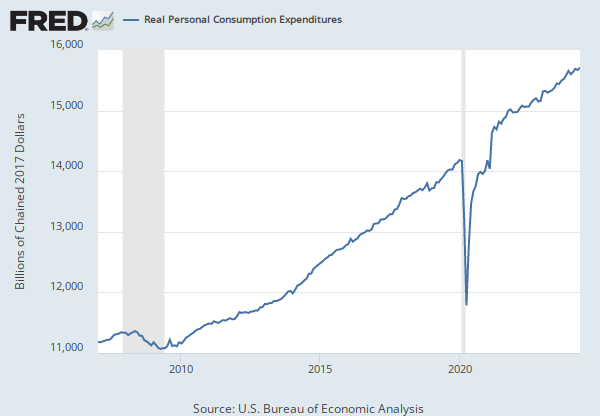

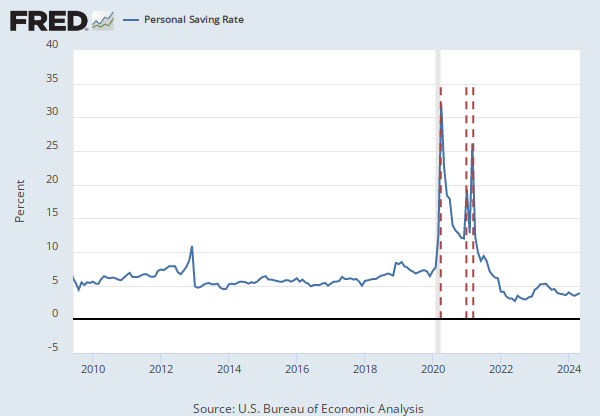

There also is evidence that we may be suffering from a COVID hangover. With the massive influx of cash from the federal government in 2020 and 2021, consumers behaved in ways not seen in recent memory. At first, with lots of new cash in their bank accounts, but while still being locked down, consumers drastically cut spending, increased their savings, and paid off debt.

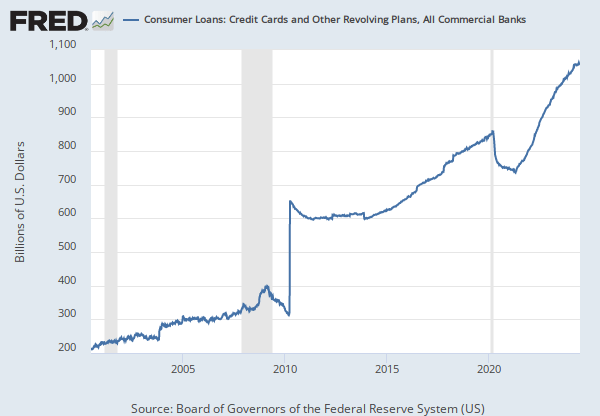

Then, by around 2022, consumers looked to credit cards after depleting their savings to support ongoing spending. Credit card debt soared to new heights.

What may be happening is more about returning to a new economic equilibrium now that consumers have spent all of their excess cash.

Finally, election year uncertainties are higher than ever, probably another source of consumer caution.

In truth, all of these factors are likely contributing to a softening of consumer spending.

So, what should a business owner do?

Tighten up Overhead

Watching your overhead is always a good idea, but it becomes crucial as revenues decline. Lowering overhead lowers a business’s breakeven point, which is the point at which you start losing money.

Pay Down Debt

Paying down debt will free up cash flow for when you may need it later if and when revenues decline. It also protects you if interest costs remain high.

Don’t Wait to React to Inflation

Inflation seems persistent right now. The best safeguard is to protect your profit margins. In addition to paying close attention to variable costs, try to stay ahead with pricing. Consumers are much more tolerant of frequent and smaller price increases than when you wait and try to do one big price increase to catch up with your increasing costs. Quarterly or even monthly small increases will be less noticeable to your customers.

Have a Plan

It is always good to have an “oh crap” plan in your back pocket. If you must make significant expense cuts to keep things afloat, have that plan ready. You may never need it, but having a cost-cutting plan in place is always a good idea.

And be ready to be decisive if you do have to act on your plan!

Entrepreneurial Voices Now Available!

I retired from Belmont two years ago. One of my retirement projects was to finally write a book my wife, Ann, and I have been talking about for decades. It was inspired by Studs Turkel’s Working, in which he interviewed people from all walks of life about their work. Most of his book contains direct quotes as people talk about “what they do all day and how they feel about what they do.”

Ann and I have always believed it would be compelling to do the same type of book to give entrepreneurs and small business owners a similar voice.

After two years in the making, Entrepreneurial Voices is now available as an eBook and paperback. Sorry, there’s no audio version…yet.

Each chapter offers essential insights and lessons on successfully starting and growing a business, captured within the context of the daily business and personal challenges entrepreneurs face. What has been most rewarding about compiling the interviews for this book is the mosaic they create about the actual reality of being a business owner. Most interviews are more about what it is like to be an entrepreneur than simply storytelling how they started and grew their business. They openly and honestly share these lessons.

I hope you will give Entrepreneurial Voices a read!

Entrepreneurial Start-ups Ain’t Easy

Start-ups ain’t easy. They can be exhilarating, rewarding, exciting, and sometimes terrifying. But they ain’t easy.

Semi-Controllable Challenges

Entrepreneurs face a myriad of challenges with their business models during the start-up process. As they engage their customers, they work at finding a real problem and a solution that fits the customers’ needs. Early on, they also face the challenges of finding the right business partners and building the right team. And then there’s the never-ending challenge of securing the finances and other resources to feed the growing business.

Starting a business is hard enough in and of itself, but start-ups never happen in a vacuum.

“Life Goes On” Challenges

The normal rhythms of life continue no matter what. People get sick. Families fall apart. Personal tragedies happen. Entrepreneurship is a vocation that exists within the context of our complex and often disrupted lives.

When people talk about the challenges of work-life balance, it is almost always unidirectional. How do the challenges of a start-up impact my non-work life and create a work-life imbalance? However, the reality is that challenges in our non-work life can create even bigger challenges in our work as entrepreneurs. Sometimes, the non-business challenges entrepreneurs face can create the biggest risk for growing entrepreneurial ventures.

Tyler King, the founder of a personal chef and catering business called Tastify, faced significant health issues during the early stages of his business that could have led to the failure of his new company. First, he had to endure back surgery, which made the physical work of catering impossible for a time. But, Tyler faced the biggest challenge during his recovery from back surgery:

“After I had gotten through back surgery, I had scheduled a wedding for 150 people. It was going to be at the 30-day mark after surgery. I’d be useful, but I needed to delegate a lot of tasks. But a few weeks after surgery, I got infected. It was pretty serious stuff. My surgeon instructed me to go straight to the hospital because I was vomiting. That’s how I found out that I had a staph infection.

“It was about four days until the event. I had people that had been working for me, but nobody that really seemed to stand out except for this one girl that had worked about five events with me, who just seemed to really care. I gave her a call. It was funny. This girl and I actually used to date. We had stopped dating, and she reached out to me a few months later and said, ‘Hey, I need a job. I know that things didn’t work, but I need a job.’

“So, I gave her a call and said, ‘Hey, so this is going to sound kind of crazy, but I have to go back in and go back under and have the staph infection cleaned out. And I’m going to be on very, very heavy antibiotics for the next few days that are going to make me very sick. And we have a wedding for 150 people this weekend. I have some of the food orders in. I know you’ve never been to this venue, I know you’ve never met half my employees, and I know you’ve never met this client, but I need you to handle this for me.'” (from “Tyler King” in Entrepreneurial Voices).

Tyler overcame this set of health challenges and now runs a successful business. How did Tyler do it? One word: resilience.

Resilience

Experts are paying a lot of attention to the importance of resilience in entrepreneurs’ success. Researchers examining resilience find that positive personality, motivation, confidence, focus, and perceived social support all play key roles in protecting people from the negative effects of stressors (Fletcher and Sakar 2012).

Victoria Usher, founder and CEO of GingerMay., suggests that there are three specific steps an entrepreneur can take to improve their resilience:

- Face your challenges head-on. In the example of Tyler King, he did not wallow in his health challenges. He faced them head-on and sought solutions to make it through each challenge.

- “Innovation”. Usher suggests that entrepreneurs should look at each challenge as a problem-solving opportunity. Innovation is a process that often involves several attempts to reach a solution. Each attempt generates valuable information that will eventually lead to a solution.

- “Mentorship”. Seek advice, coaching, and counsel from mentors who can help you improve your business and yourself. From the coaching I do for entrepreneurs, I know that some of the most impactful sessions are those when I help them see above the “fog of battle” when dealing with the challenges they face in life and business. I rarely offer brilliant insight into their problems. Instead, I simply remind them of things they already know but have lost sight of while trying to manage a challenge or crisis.

Usher calls resilience the “new cornerstone for entrepreneurship.” Entrepreneurs find success in start-ups through a combination of adaptation and innovation, a constructive mindset, and a strong network of coaches and mentors that all help to build resilience. After all, start-ups ain’t easy.

UPDATE: Fresh Eyes See Opportunities for Innovation

I have an update for the post “Fresh Eyes See Opportunities for Innovation.”

The founders of Cour Design have announced the launch of their new product from their business, Syne. It is called NP-19, which is a 19-inch screen that shows you what’s “Now Playing” from your playlist. It connects with how you stream music, to show album artwork and other now-playing information on a dedicated display.

Something I miss from the golden age of vinyl albums is the album cover and the artwork that went into its design. NP-19 brings this back to life.

You can get more information on their new product here.