I will be giving a talk to our local chapter of Entrepreneurs Organization (EO) this Friday on leadership. Preparing for this talk has been like a walk down memory lane.

Back when I studied business as an undergrad in the 1970s we recently moved away from what was known as the Trait Theory of leadership. This view held that we could identify common traits of leaders and use them to predict future leaders. Although this is a simplification, we got to the point were we concluded that successful leaders were tall white men with really good heads of hair. I like to call it the Ward Cleaver theory of leadership. All leaders looked a lot like the father in the old Leave it to Beaver television show. For those of you too young to remember this show, we decided that effective leaders looked something like this:

The leadership theories that replaced trait theory were those that focused on what the best leaders do.

By the time I got to my MBA program the latest thinking was that effective leadership depended on the situation — the kind of jobs we supervised, the level of the people we were in charge of, the type of industry we were in, etc., etc.

When I got into my doctoral program, those who studied leaders were scratching their collective heads. It seems that no theory of leadership that came along explained leadership fully, and some vestiges of all theories helped explain at least some part of leadership.

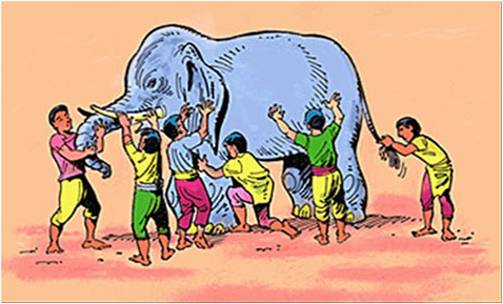

My mentor in grad school told us that it was like the theory of the blind men and the elephant. Each one could only perceive the part of the elephant that he could touch, so each incorrectly described the elephant in its entirety.

So where are things today?

Heifetz, Grashow, and Linsky have an interesting view in the July-August 2009 Harvard Business Review. Their view is that we will be facing a period of crisis for some time. Leaders must be able to become adaptive. More importantly, they need to create a “culture of interdependence” that focuses on adaptation. They define leadership as a process that transcends any individual. They conclude the following:

Achieving your highest and most noble aspirations for your organization may take more than a lifetime. Your efforts may only begin this work. But you can accomplish something worthwhile every day in the interactions you have with the people at work, with your family, and those you encounter by chance. Adaptive leadership is a daily opportunity to mobilize the resources of people to thrive in a changing and challenging world.

I like this view, and think it captures the true meaning of integrity — not just in how we lead our organizations, but how we lead our lives day by day. Good advice for these difficult and confusing times.