I have been rebutting Scott Shane’s maligning of small business in the economy in this blog for some time. Prof. Shane is an economist who teaches entrepreneurship at Case Western Reserve U. (You can see those posts here, here, here, here, here and here).

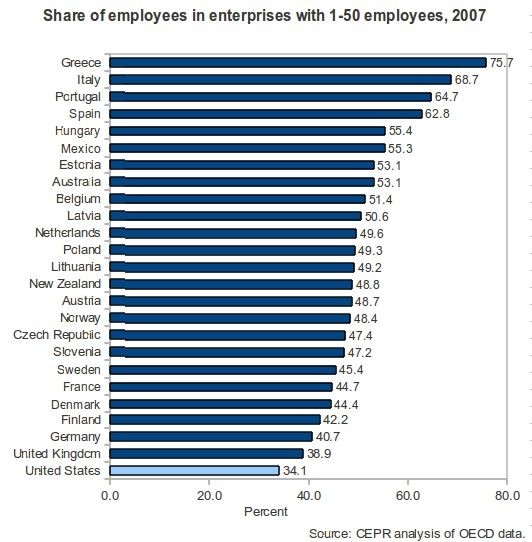

Now we have a post at the Economist blog, Free Exchange, that examines the role of small business as an engine of jobs in the U.S. economy. They start with this graph:

“Entrepreneurs boost the economy by exploiting new ideas and business

models in order to turn a profit. The ones that do this well don’t stay

small; they grow rapidly, helping to disseminate new technologies and

create jobs. If your economy has a lot of small firms, that’s an

indication that some part of this process is broken. If you look at the

Italian example, for instance, you find that a lot of small Italian

firms are retail and service enterprises protected from competition by

onerous regulation.”

I guess economists can’t help themselves. It may seem that they disdain small businesses, but it may just be how they get trained to think. Classic economic theory never has really had a place for small business.

I studied economics at undergraduate level (a minor), MBA level (applied econ), and doctoral level (in my DBA program had to take the same two intro PhD Econ courses as Economics PhD”s did), so I have a sense of where this comes from.

Economists view commerce as a place where small businesses compete again each other. The strong beat out the other small firms and become larger. Then the larger compete against each other and the largest win and get to be really big monopolies. It is a static model that for the most part minimizes disruptive innovation, or as we like to call it, entrepreneurship. It is also a view that takes out the emotional and psychological aspects of entrepreneurship — passion, risk tolerance, ethics, values, life/work balance, and so forth.

Their world view is one of only purely rational economic goals. Entrepreneurs start ventures for so many more reasons that that. We want to create jobs, build a certain kind of culture, find safe and cool niches to operate in profitably, etc., etc. etc. It is rarely to simply maximize shareholder’s wealth (our own in this case).

To do so impinges on our other goals, exposes us to outside funding requirements that are just not worth the hassle (i.e., banks and their personal guarantees and venture capitalists and their term sheets), and can just plain take the fun out of owning and running a business.

And by the way — this analysis is based on about seven decades of a very different economy that was dominated by large firms. That economy stopped creating jobs back in the 1980s. Most research shows that entrepreneurs created about 75-80% of all new jobs from about mid 1980s up until the Great Recession began in 2008.

The good news is that most of the time economists just talk to other economists.